A Simple Guide to Child Care Subsidy

“I’ve heard about Child Care Subsidy, but how does it actually work?”

At Imagine Childcare, this is one of the top questions we’re asked by parents enquiring about our centres.

And it’s easy to see why. When you first look into CCS, it can seem like a complicated process. To help make your childcare journey as simple and stress-free as possible, we’ve written this simple guide to help assist you with some of the questions you may have about the CCS process.

Please note, that we’ve written this for general guidance and it does not cover every nuance and detail of CCS. For full details, we strongly recommend you visit Services Australia

What is Child Care Subsidy (CCS)?

Put simply, CCS is an amount paid by the Australian Government to your childcare provider, to reduce your out-of-pocket costs on the fees you pay for your childcare service.

Why do we have CCS?

Every Australian family should have access to quality childcare and early education. CCS helps makes quality care and education affordable and obtainable for all families regardless of their individual circumstances.

Who is entitled to CCS?

There are a number of requirements you must meet to be eligible for CCS:

You or your partner must:

- Meet residency requirements

- Meet the requirements of the CCS activity test

- Be liable to pay for your childcare fees under a written agreement with your approved childcare provider

Your child must:

- Be attending an approved childcare provider in Australia

- Have their immunisations up to date or have an approved exemption

- Be under 13 years of age (and not be attending secondary school)

- Be a ‘Family Tax Benefit child’ or a ‘regular care child’

How much CCS am I entitled to?

The amount of CCS you are entitled to is based on three areas:

- Your combined household income

- An activity test

- The type of childcare service your child will enrol in

Your Combined Household Income:

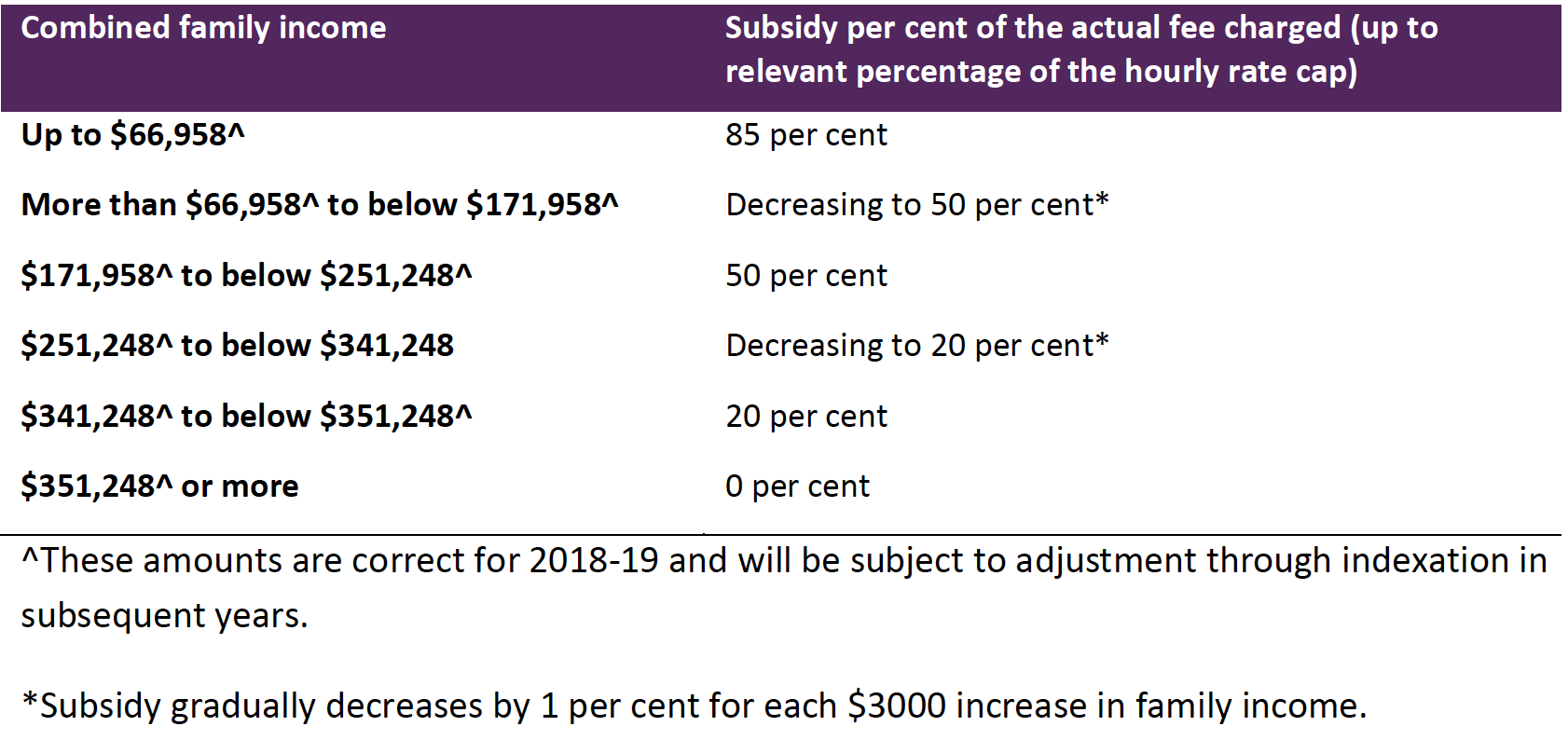

Please see the table below for the percentage of subsidy applicable to your combined household income:

Activity Test

As part of your CCS application process, you will complete a three-step activity test. This activity test will determine how many hours of subsidised care you are entitled to. Both parents (if applicable) are taken into account here and must meet the activity test (unless one or both have an exemption), however your maximum hours are based on the person with the lowest level of activity.

It is important to note that activity is not just hours worked in your regular job. Recognised activity can include paid work, unpaid voluntary work, study or training to improve employment prospects, hours spent actively looking for work, and even your travel time between your place of work and your approved childcare provider.

If your activity is irregular (for example you work as a casual employee), you can estimate your activity based on the highest number of hours you will work in any fortnight over a three-month period.

You self-declare this information to Centrelink as part of your application process, however spot checks may be carried out and evidence may be required. This could be a payslip or a letter from an organisation you volunteer with for example.

Exemptions to the activity test

There are certain circumstances that you may meet, where you will be exempt to the activity test, and be eligible for 100 hours of subsidised care per fortnight. These include: if you have a disability or impairment, are travelling or living outside of Australia for up to six weeks, or if you are a grandparent who is the principal carer for your grandchild and you do not receive income support payments (see our section on Additional Child Care Subsidy if you do). There are many other reasons you may be exempt. Visit Services Australia here to find out if you are exempt.

In exceptional circumstances, where it is unreasonable for your family to meet the activity test requirements, you can apply to Centrelink and they will assess the information on a case-by-case basis.

Service Type

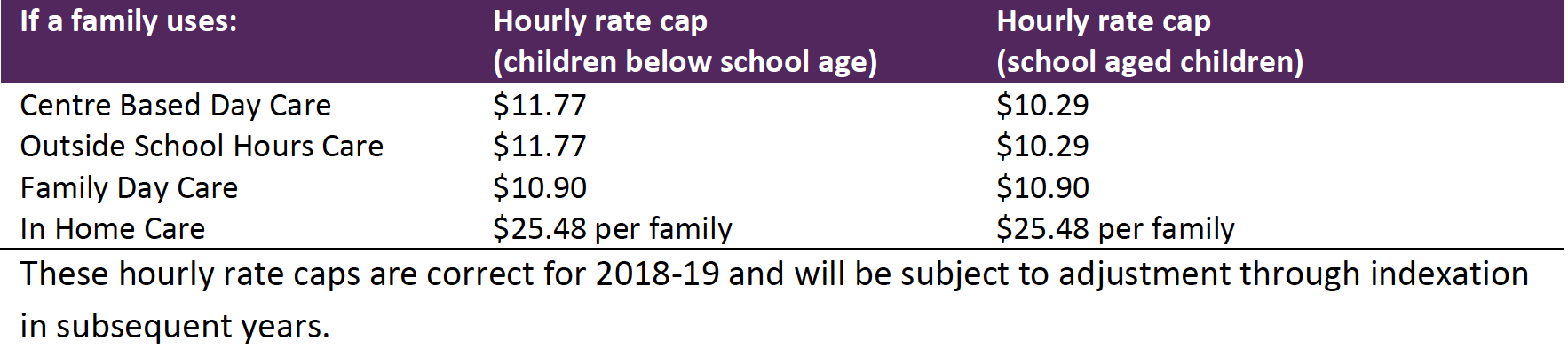

Is the childcare service you are enrolling your child in centre-based daycare, outside school hours care, family daycare, or in-home daycare?

This is important as the hourly rate cap for each hour of childcare provided depends on the type of approved service used.

For example, if your childcare provider charges less than the hourly rate cap below, your subsidy will be your CCS percentage of the actual fee charged by the provider. If your childcare provider charges more than the hourly rate cap, your subsidy will be your CCS percentage of the hourly rate cap applicable to the type of service you are using.

How is my CCS paid?

Your CCS is paid directly to your childcare provider. This means you’ll only ever pay your childcare provider the difference between your subsidy amount and the full fee.

That’s why it’s extremely important to remember to apply for CCS before your child begins care. As our experts recommended above, apply for your CCS at least two months before your child starts care, to ensure you CCS is approved and ready to go when you child begins care.

Of course, you may start childcare before your CCS is approved, however please be mindful that you will be liable for the full fees until your subsidy is approved, and you will only be backdated for 28 days from your application approval date and only if you are a new applicant. This backdated amount may not be paid to the centre directly, but rather to you.

Withholding CCS

The Australian Government will withhold 5% of your CCS entitlement before it is paid to your childcare provider. This is to reduce the likelihood of you incurring a debt by being overpaid your CCS entitlement.

You can nominate for this amount to be adjusted up or down, however keep in mind that if you are overpaid you will incur a debt to be paid at the end of financial year. If you are determined to have underpaid your CCS entitlement at the end of financial year reconciliation, you will be paid this back as a lump sum.

Can I get my CCS paid out as a lump sum at any time?

You can’t elect to have your subsidy paid out as a lump sum. As above, in the case that there is any CCS owed to you following the end of financial year reconciliation process, you will be paid this directly as a lump sum. In the case that you have been overpaid your CCS during the year, you may have to repay it as a debt. That is why it is so very important for you to give Centrelink accurate information on your application and keep them up to date with any changes in your circumstances or details.

If my child is absent from care, will this affect my subsidy?

You are allowed 42 absences from your childcare service every financial year, for any reason such as public holidays or sickness, without needing to provide documentation. Please note that these absences only pertain to days where your child would normally be enrolled in care. Your service provider will keep a record of these days, and you can view these at any time in your Centrelink account in myGov.

Additional absence days can be paid by Centrelink, provided the circumstances meet those defined by Family Assistance Law and documentation is provided to explain the approved absence. Some of these include if the service is closed due to an emergency, if you or somebody in your household is unwell, or if your child is spending time with another person besides their normal carer as outlined by a Court Order or Parenting Plan.

What is the Additional Childcare Subsidy?

This is a top up payment, additional to CCS, which provides extra assistance to families who need additional support due to one or more of the following circumstances:

- If a child is considered to be at risk for the purposes of ACCS (Child Wellbeing). It could be they have been subjected or exposed to harm, abuse, neglect, domestic, or family violence in the past, currently, or potentially future.

- You are the child’s grandparent and their primary carer, and you are receiving an income support payment

- You are experiencing temporary financial hardship

- You are transitioning to work after receiving income support payments

To find out more about the Additional Childcare Subsidy and the circumstances that qualify, please visit Services Australia here.

Is there anything else I should know?

Check out our second article in our Childcare Subsidy Series – Applying for Childcare Subsidy: Process to Follow – for the steps to follow when you are ready to apply for your CCS.

Keep in mind that this is only a very simple guide to the CCS process to help make things clearer as you begin your childcare journey. For full details on CCS – including the application and approval process, eligibility requirements, exemptions, additional subsidy, and circumstance changes – we strongly recommend you visit Services Australia.